What is a Delinquency Rate Spreadsheet?

The delinquency rate spreadsheet is a free financial tool designed to help businesses track overdue payments and assess the overall impact of customer non-payment on cash flow and profitability.

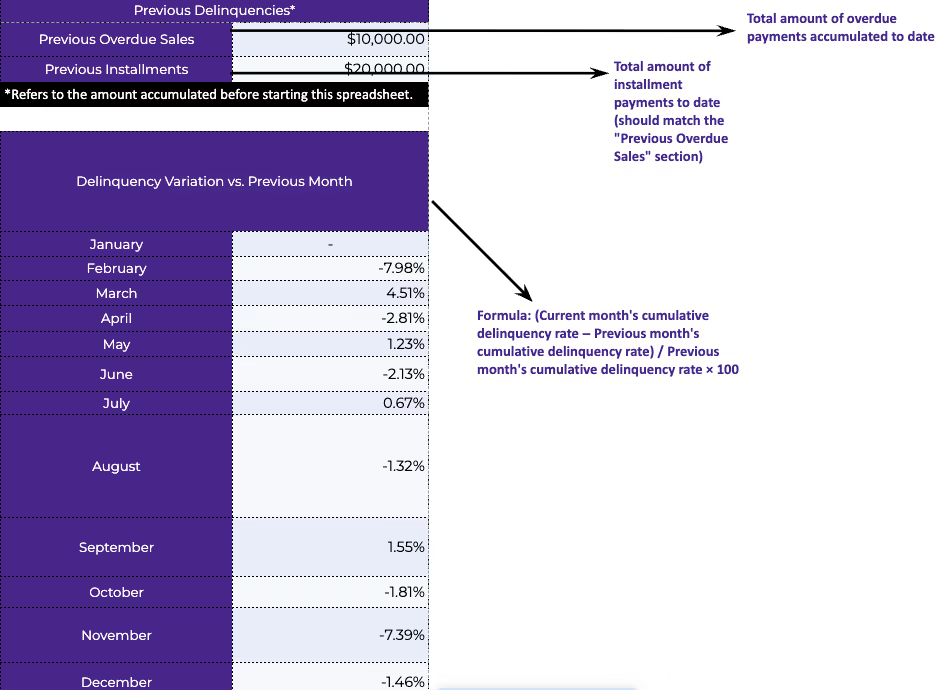

By consolidating key metrics, this tool allows companies to monitor their delinquency rate over time, helping to identify trends, make informed decisions, and evaluate financial health.

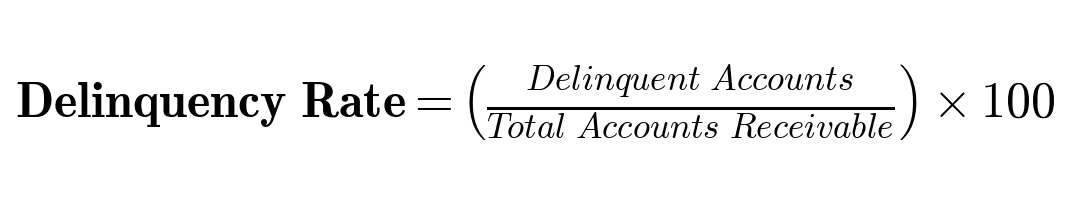

What is delinquency rate?

Delinquency rate refers to the percentage of outstanding receivables that are past due for a specific period. It is a key financial metric used to measure the efficiency of credit and collections operations.

Delinquency rate formula

Want to know how to calculate delinquency rate for your business? Our free spreadsheet does it for you — automatically.

Why is delinquency control important?

Effective delinquency control prevents cash flow issues and ensures your business stays financially healthy.

Benefits of tracking delinquency rate

📊 Continuous monitoring

Track overdue invoices regularly to spot patterns and fluctuations in your delinquency rate over time.

💡 Data-driven decisions

Base your collection strategies on accurate, real-time data from your business operations.

💰 Financial health assessment

Understand how delinquency directly affects your cash flow and profitability.

📈 Performance analysis

Evaluate the effectiveness of your debt-reduction initiatives and adjust your strategies as needed.

How does this spreadsheet work?

When you download the spreadsheet, you'll find four organized tabs:

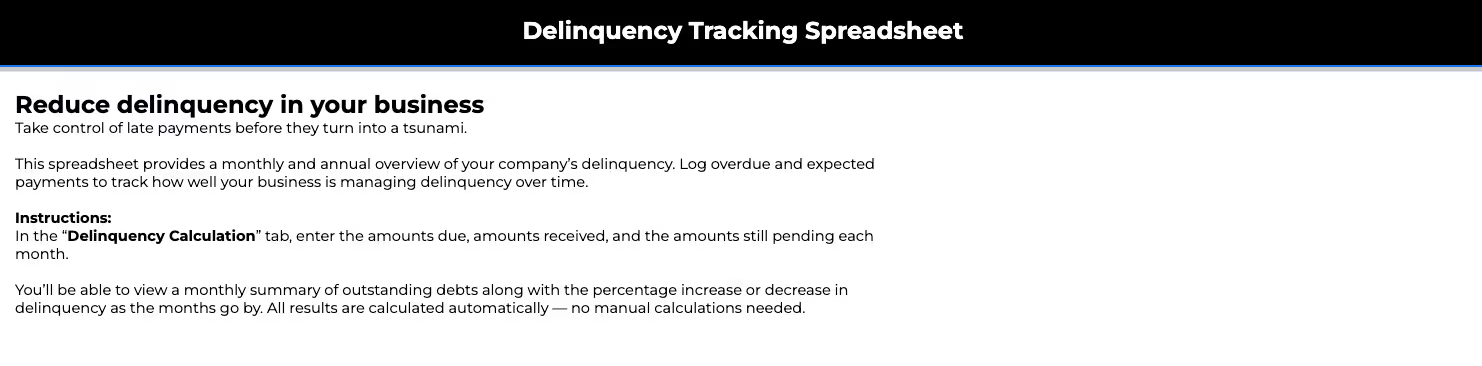

🧭 Instructions tab

Here, you’ll get a clear view of all the information included in the spreadsheet, with a practical example already filled out.

Each column contains a specific value and a detailed explanation of what should be entered or will be automatically calculated based on the other inputs.

📌 Usage Guidelines tab

Get a preview of a completed example with detailed explanations for each column — so you know exactly what to input and what’s calculated automatically.

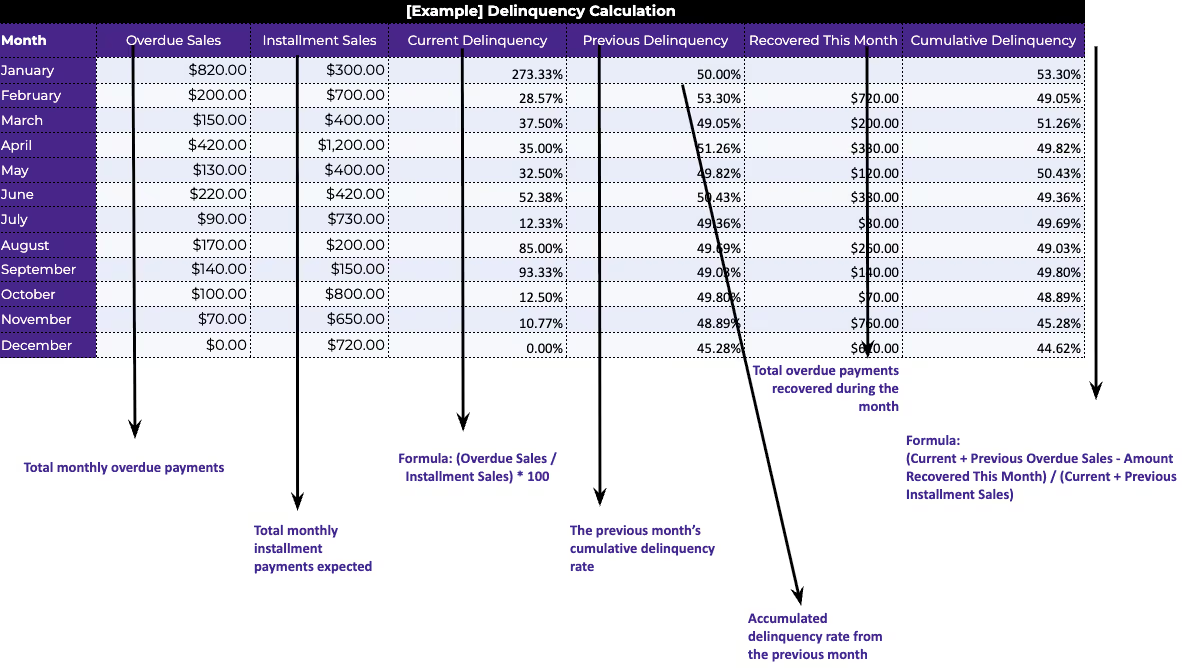

📅 Delinquency Calculation tab

In this section, you can enter data month by month to understand and visualize how delinquency is being managed in your company.

Gray-shaded cells are automatically calculated and do not need to be filled in manually.

Start tracking your delinquency rate today

Whether you're just starting to monitor late payments or need a more structured way to calculate delinquency rates, this spreadsheet is for you.

You can also combine it with our Cash Flow Spreadsheet for even better financial control.